Better Debt Management

You require to honestly assess and research your monetary scenario to better handle you financial debts. Combine financial debt lendings is just one of the most regularly use program or method of taking care of this burden. If you realized that you are not making ends satisfy, after that it is the moment to consult with a credit history counselor. If you are encourage that bankruptcy or therapy is not yet appropriate for you, there are other alternatives. The choice to consolidate financial obligation loans could be your very first step to your economic health.

There are numerous methods to consolidate financial debt car loans for your monetary wellness. You require to recognize and find out just how to have an excellent handle on your financial debts as well as finances. Dealing with your monetary issue by yourself can be very easy too. However you require the overview and also info to guide in advance. There is an extremely suggested financial obligation negotiation and negotiation service which is offered to you online. It is simple and as basic as signing up for a short subscribe type.

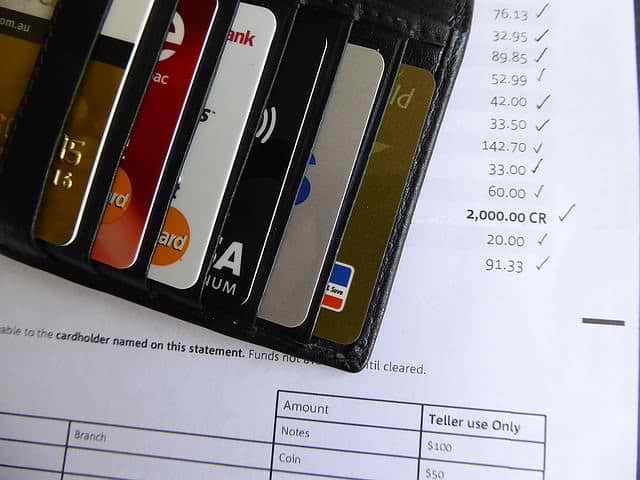

Debt combination is one of the most convenient means you can do. You can likewise apply for a low interest bearing credit card and also put all your credit card debts in one single credit card. In this manner you do not require to collateralized your loaning. No requirement for a promise or a house equity as collateral. Put simply, equilibrium transfer is not a bad suggestion if you can have great manage on your funds. Make sure to consist of all the high passion bank card that you have.

Some consulting and debt management companies do supply debt negotiation and also arrangement solutions. These companies will certainly bargain on your behalf as well as would lessen your insolvency by a substantial quantity. Browse the web and also search the internet for all sources you need.Then you will certainly be impressed to find a great deal o these companies and also therapists that supply these solutions.

There are a great deal of benefits when you combine debt financings through financial obligation monitoring agencies. Do not be scared regarding the notions of companies scamming you. All you have to do is make certain that you understand the terms. Do not authorize until you totally recognize what you are getting into. You will constantly locate those companies that really on your behalf. The good idea is you do not have an one-on-one with your loan providers.

They will certainly discuss as well as get a simple to adhere to program and also debt payment schedule. All you have to do is adhere to the program to the teeth and make your month-to-month settlement. Having a worked out settlement will ease the financial burden and issue that is bothering you.

The various other method to consolidate debt lendings is with a collateralized small business loan or house equity financing.

Whichever that fits your situation, do not wait too long. Much too often if you wait also long, your financial debt trouble becomes worse. As well as when it becomes worse the tougher you will locate a better deal for your economic distress. Debt combination financing will always be a great way of handling insolvency.

Do on your own a favor as well as decrease your monthly expense repayments, lower your rates of interest, as well as decrease your financial debt issues. Consolidate financial obligation lendings is possibly your ideal choice for your financial health. For more tips on dealing with debt problems by going to this link, https://joannedewberry.co.uk/how-debt-can-hurt-you-at-work/.